Timely Insights

Welcome to the Mainstream Era of Crypto

San Francisco • July 11, 2023

Dear Investors,

When the history of crypto is written, I believe we'll look back at this quarter as a turning point. And there's one reason for that: BlackRock's filing for a spot bitcoin ETF on June 15.

Sure, there were other salient events: the U.S. Securities and Exchange Commission (SEC) filing lawsuits against Coinbase and Binance; Grayscale having its day in court with the SEC; and so on.

But none compare with the world’s largest asset manager, with $9 trillion under management, planting its flag in the ground and saying: “Bitcoin matters and investors want to buy.”

Just how big of a move was it? I would go so far as to call it the beginning of the Mainstream Era, one in which we believe:

crypto will enter the portfolios of most professional investors, including financial advisors, pensions, endowments, and sovereign wealth funds;

crypto applications—from crypto-native apps like Uniswap to projects by traditional companies like Nike—will be adopted by millions, and then billions;

regulation by enforcement will give way to common sense legislation, so that the investor protections of traditional securities laws can coexist with the innovations that crypto and blockchain provide; and

crypto will start to meaningfully reshape how money, finance, creativity, and identity function in our day-to-day lives.

If you’ve been following Bitwise’s commentary, you know that crypto has been laying the groundwork for its mainstream ambitions for a while. We’ve been telling everyone who will listen about the vital technical breakthroughs, like the rise of Layer 2 solutions, that will allow crypto networks to scale to mainstream size. And indeed, crypto investors haven’t been waiting around for BlackRock: Bitcoin was up more than 50% year-to-date prior to the BlackRock announcement (it’s now up ~80%).

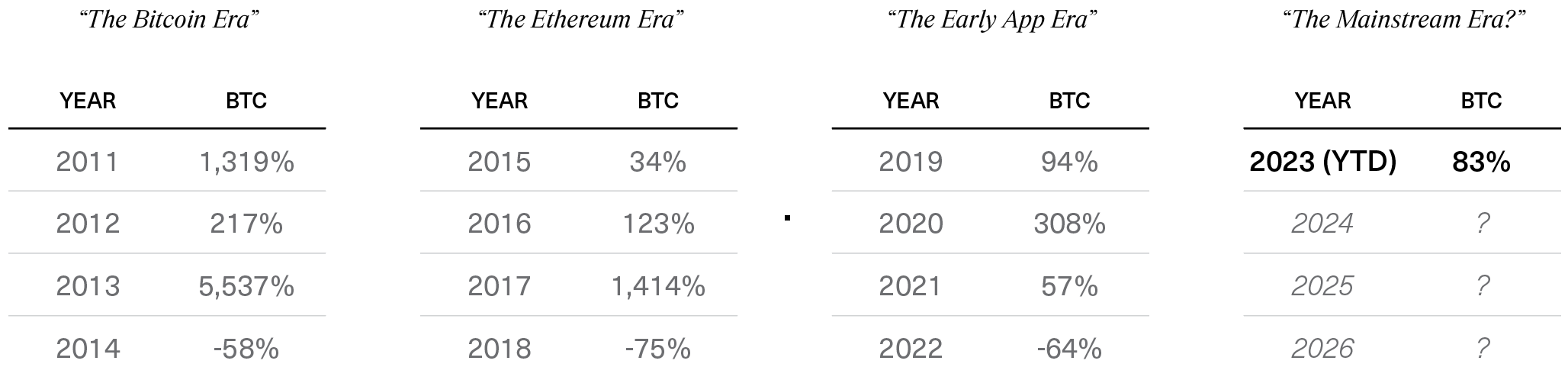

Bitcoin’s price has historically moved in four-year cycles, driven by fundamental technical advances. Is this the start of a new era?

Source: Bitwise Asset Management. Data from January 1, 2011, through June 30, 2023. Performance information is provided for informational purposes only. Returns reflect the return of bitcoin itself, and not of any fund or account, and do not include any fees. Backward-looking performance cannot predict how any investment strategy will perform in the future. Future crypto cycles may not be four years long; the four-year increment is based on historical data for illustrative purposes and is not a prediction of future results. This material represents an assessment of the market environment at a specific time and is not intended to be a forecast of future events, or a guarantee of future results.

But it is one thing for crypto experts to wax poetic about the technical capabilities of Layer 2 solutions and quite another thing for the world’s largest asset manager—serving essentially every institutional investor in the world—to put its weight behind bitcoin for the long haul.

That, by the way, is the primary reason the filing matters. Sure, it is nice that BlackRock—as sophisticated and connected as they come—believes that the market has matured enough that the SEC will allow a spot bitcoin ETF to launch. And yes, it’s nice to know that they have a 575-1 track record of winning approval from the SEC for ETF filings. And of course, it is fun to think about how much money might flood into a spot bitcoin ETF, and what that would mean for prices.

But the real reason this matters is that the big question around bitcoin—really the only question—is whether it will be important in 20 years or not.

Bitcoin today, at a $600 billion valuation, sits at an unstable equilibrium. It is both too small to matter and too large to ignore. It cannot muddle along in this state of future promise forever. It must either vault into the sustainable big leagues—a major asset that everyone accepts is an important part of our world, like gold—or fade to obscurity, beloved by only a small band of committed technologists.

The world’s largest asset manager putting its full weight and reputation behind the space tells me strongly that it's the former. It is now, to me, only a matter of time, and primarily a question of how many zeroes are added to its market cap.

As if to underscore this point, BlackRock’s ETF filing was not the only institutional breakthrough in the past two weeks. We also saw both Deutsche Bank and French asset-servicing giant CACEIS register crypto custody businesses; Charles Schwab, Citadel, and Fidelity launch a spot crypto exchange; and no less a figure than Federal Reserve Chairman Jerome Powell say that crypto “appears to have staying power as an asset class.”

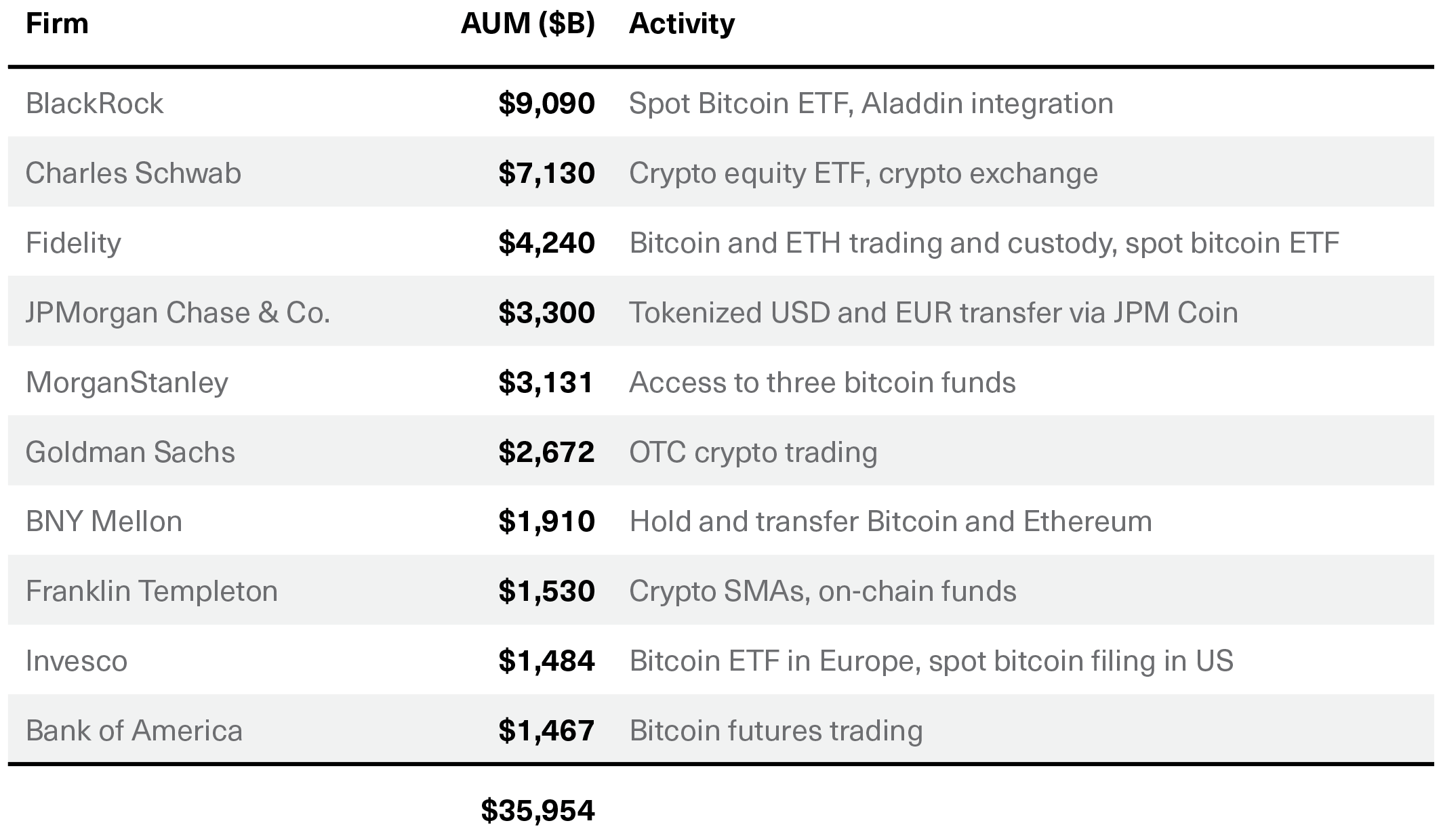

This has been an emerging truth for quite some time. Many of the largest asset managers in the world are currently working on crypto-related products. Looking at just the largest players, we count firms with a collective $36 trillion in AUM targeting the space.¹

Of course, this is not to say that there is no risk. There is no guarantee that BlackRock (or Bitwise) will be successful with its filing. After all, while BlackRock has a good track record getting ETFs approved, the SEC’s record in rejecting spot bitcoin ETFs is a remarkable 32-0. We could also see more regulatory enforcement actions, or other surprise developments, that could challenge this positive momentum.

But those would be short-term setbacks; from our vantage point, they would only push mainstream adoption further into the future. They wouldn’t stop it.

For investors, the question now is what you do with this information. Do you wait for the SEC to formally approve a spot bitcoin ETF, given the very real risk that this current batch of filings may come up short?

Or do you jump ahead of the wave of institutional capital that we expect to flow once crypto’s Mainstream Era begins in earnest?

If market movements and the conversations we’re having are any indication, investors are increasingly deciding that the time to act is now.

(1) This table was inspired by and builds on a tweet by Meltem Demirors, the Chief Strategy Officer of CoinShares.

About Bitwise

Bitwise Asset Management is the largest crypto index fund manager in America. Thousands of financial advisors, family offices, and institutional investors partner with Bitwise to understand and access the opportunities in crypto. For six years, Bitwise has established a track record of excellence managing a broad suite of index and active solutions across ETFs, separately managed accounts, private funds, and hedge fund strategies. Bitwise is known for providing unparalleled client support through expert research and commentary, its nationwide client team of crypto specialists, and its deep access to the crypto ecosystem. The Bitwise team of more than 60 professionals combines expertise in technology and asset management with backgrounds including BlackRock, Millennium, ETF.com, Meta, Google, and the U.S. Attorney’s Office. Bitwise is backed by leading institutional investors and has been profiled in Institutional Investor, Barron’s, Bloomberg, and The Wall Street Journal. It has offices in San Francisco and New York. For more information, visit www.bitwiseinvestments.com.