Research

Crypto Equities: A "Domestic Emerging Market" for the 21st Century

San Francisco • September 15, 2023

For the past 20+ years, investors have eyed emerging markets as a source of untapped growth. Emerging markets came with risks—political, regulatory, currency, and others—but they also presented the opportunity for rapid growth that had low correlations to U.S. or other developed markets.

As we inch further into the 21st century, however, many emerging markets have at least partially emerged, and the yawning gap between the U.S. and other economies has narrowed.

Fortunately, there is another emerging opportunity where untapped, uncorrelated growth has been hidden by regulatory and other risks: the crypto industry, and more specifically, crypto equities.

As the crypto industry takes shape, these companies are seeing significant growth. And as crypto assets reach mainstream adoption and more use cases emerge, companies in the space stand to capitalize on their long-term potential.

The Case for Considering Crypto as an Emerging Market

Untapped Growth

Emerging markets are all about untapped growth. This can translate into expanding revenues and profits for companies, offering potential upside for investors. Crypto usage has grown at an exponential pace, with new applications of crypto technology emerging across a wide range of industries.

Building the New Digital World

Picture a young, tech-savvy population, hungry for innovation and growth. Emerging markets tend to be underpinned by younger populations, which is also the case with crypto.

Innovation at Hyperspeed

The pace of development in the crypto realm is staggering. And the companies at its forefront? They’re adapting, pivoting, and innovating at speeds that would make emerging market firms envious.

Global and Borderless

One of the appeals of emerging markets is their global nature. Crypto equities take this up a notch. Crypto is not bound by geography; its reach is truly global, tapping into communities and economies worldwide.

Regulatory Uncertainty

Just as with emerging markets, crypto regulation is global, complex, and evolving. At Bitwise, we’re bullish on the long-term outlook for crypto regulation, and believe it will turn into a tailwind for the space (as political breakthroughs have for certain emerging markets). The risk, however, is significant.

Undercovered by Wall Street

Emerging market companies can slip under Wall Street’s radar—with scant analyst coverage, many investors can miss opportunities. The same is true in crypto, where many companies have little or no coverage from sell-side analysts.

Currency Risk

A significant factor in emerging market returns is currency risk—rising or falling currencies can significantly impact the earnings of companies located in emerging market countries. Crypto equities face similar risk with their own “currencies,” as rising or falling prices for bitcoin and other cryptocurrencies can dramatically impact underlying returns.

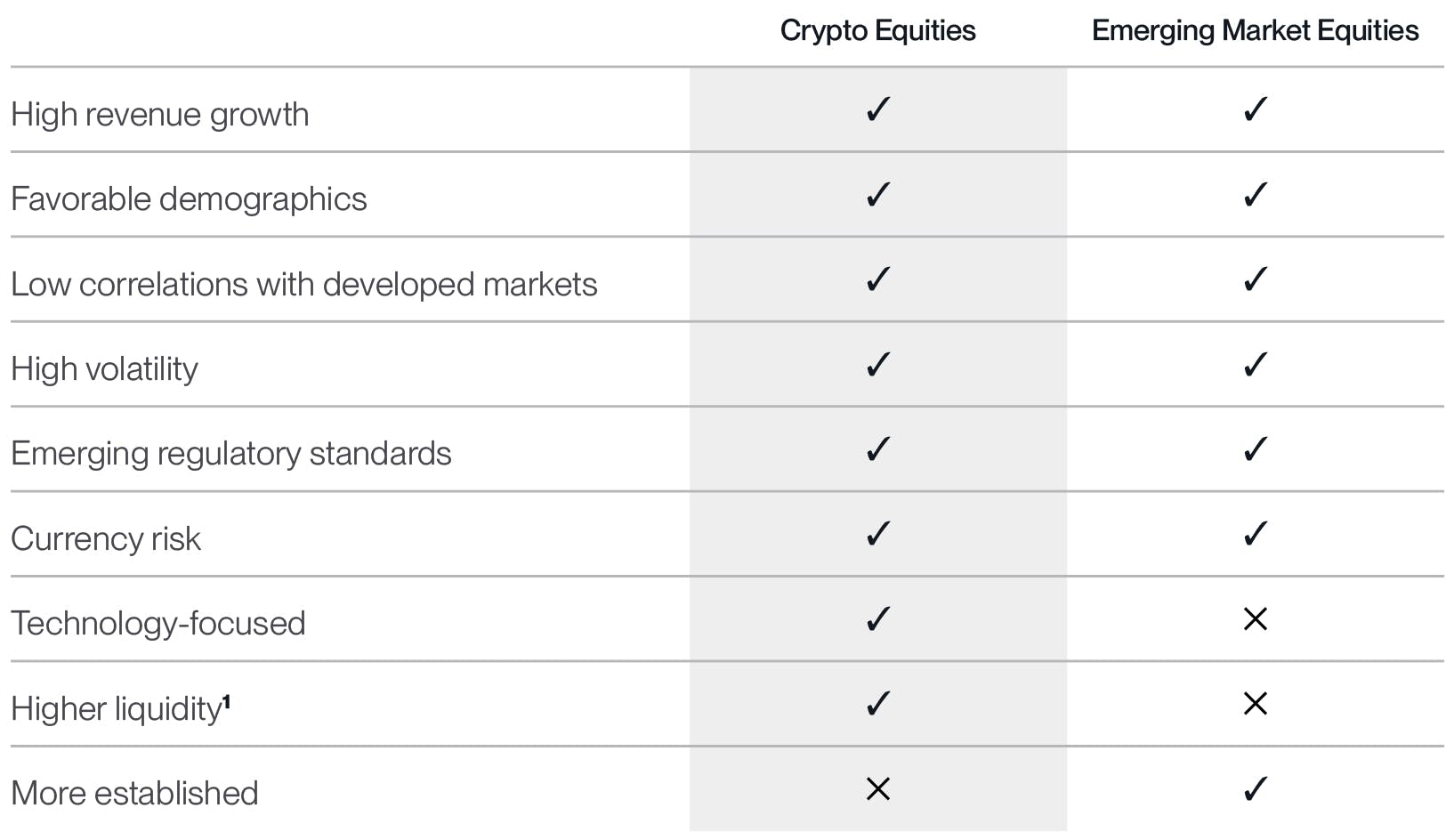

Crypto Equities vs. Emerging Market Equities in a Portfolio

Emerging-market investors are typically looking for two major characteristics: Strong growth and uncorrelated returns.

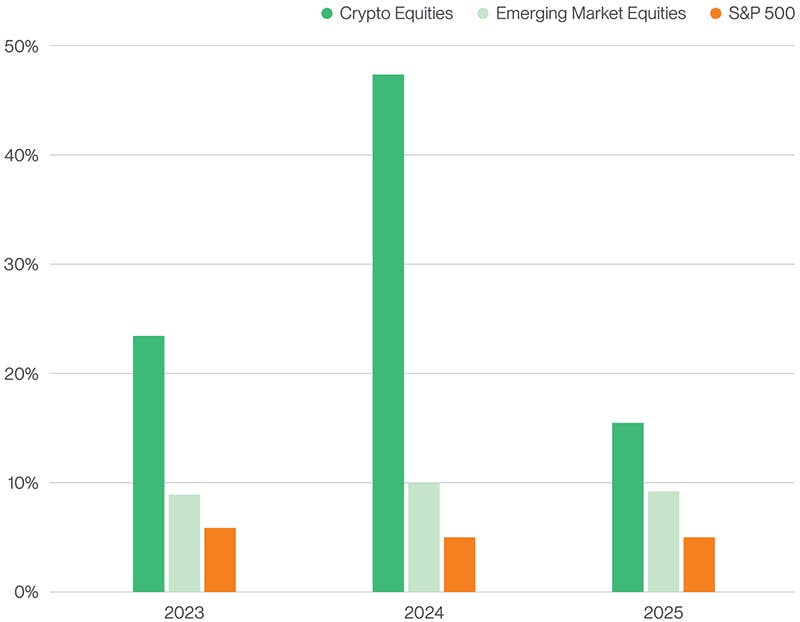

Revenue Growth

As this chart shows, emerging market companies are indeed on pace to grow revenues faster than the S&P 500.² But crypto equities are projected to grow even faster, with the median crypto equity expected to grow revenue by 23.57% in 2023, 47.26% in 2024, and 15.83% in 2025.³

Median Projected Revenue Growth

Correlations

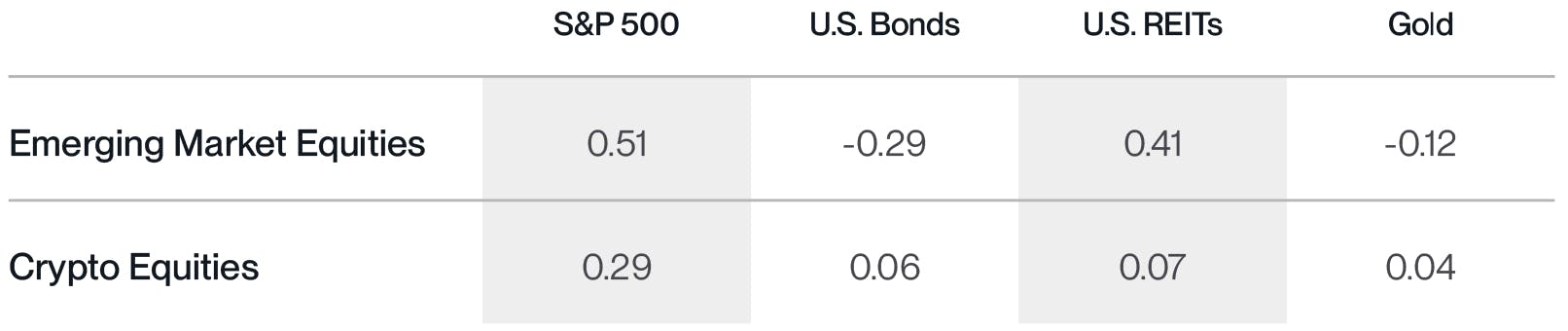

Emerging market equities provide investors with a return stream that has a low correlation to the S&P 500, measuring just 0.51. This can make them a valuable addition to portfolios under many market conditions.

Crypto equities, however, have an even lower correlation at just 0.29, which can make them an even more powerful tool for portfolio diversification.

Correlations Table

Source: Bitwise Asset Management with data from Bloomberg. Data as of June 30, 2023.

Note: “S&P 500” is represented by the S&P 500 Total Return Index. “U.S. Bonds” is represented by the Bloomberg U.S. Aggregate Bond Index. “U.S. REITs” is represented by the MSCI US REIT Gross Total Return Index. “Emerging Market Equities” is represented by the MSCI Emerging Markets Net Return USD Index. “Crypto Equities” is represented by the Tier 1 constituents of the Bitwise Crypto Innovators 30 Index. “Gold” is represented by the gold spot price.

Conclusion

Emerging market equities have historically played a unique role in a traditional investment portfolio: For most investors, it’s about the potential for enhanced returns and diversification. With the changing shape of the global economy, however, an argument can be made that the real emerging economies are on the cutting edge of technological frontiers. Crypto equities today exhibit higher expected growth and lower correlations to U.S. stocks than traditional emerging markets.

To be clear, comparing emerging market equities to crypto equities isn’t apples-to-apples. While they share many important attributes, the underlying growth drivers and risk factors are not the same, and potential investors need to thoroughly understand the risks and opportunities that each investment presents. However, for investors looking for the diversification benefits and enhanced growth potential that they historically would have found in emerging markets, it may be time to give crypto equities a closer look.

(1) Measured by average trading volume from June 30, 2022 to June 30, 2023.

(2) Emerging market equities are defined as constituents of the MSCI Emerging Markets Index.

(3) Crypto equities are defined as Tier 1 constituents of the Bitwise Crypto Innovators 30 Index. These are companies that derive over 75% of their revenue from crypto activity or hold over 75% of their net assets in liquid crypto assets. For more information please visit https://static.bitwiseinvestments.com/BITQ/Bitwise-Crypto-Innovators-30-Index-Methodology.pdf.

Index Definitions

The MSCI US REIT Gross Total Return Index (RMSG) is a free float-adjusted market capitalization-weighted index that is comprised of equity Real Estate Investment Trusts (REITs).

The MSCI Emerging Markets Net Return USD Index (M2EF) captures large- and mid-cap representation across 24 Emerging Markets (EM) countries.

The S&P 500® Total Return Index (SPXT) tracks the performance of 500 large-cap publicly traded companies in the U.S.

The Bitwise Crypto Innovators 30 Index (XBITQ) is an equity index that provides focused exposure to companies that are building the future of the crypto-asset-enabled decentralized economy.

About Bitwise

Bitwise Asset Management is the largest crypto index fund manager in America. Thousands of financial advisors, family offices, and institutional investors partner with Bitwise to understand and access the opportunities in crypto. For six years, Bitwise has established a track record of excellence managing a broad suite of index and active solutions across ETFs, separately managed accounts, private funds, and hedge fund strategies. Bitwise is known for providing unparalleled client support through expert research and commentary, its nationwide client team of crypto specialists, and its deep access to the crypto ecosystem. The Bitwise team of more than 60 professionals combines expertise in technology and asset management with backgrounds including BlackRock, Millennium, ETF.com, Meta, Google, and the U.S. Attorney’s Office. Bitwise is backed by leading institutional investors and has been profiled in Institutional Investor, Barron’s, Bloomberg, and The Wall Street Journal. It has offices in San Francisco and New York. For more information, visit www.bitwiseinvestments.com.